Control Company Costs

A Look Inside Expenses: How Much Are Your Employees Spending?

Did you know that collectively, companies reimburse their employees billions of dollars each year? An employee expense could be as low as £2 for a coffee—or perhaps £6 for a fancy latte—and as these expenses add up, companies need to be thoughtful about how they guide this spending.

At SAP Concur, we want to make expense management as simple, automated, and accurate as possible so companies aren’t losing a cent to inaccurate forecasting, inefficient policies, or noncompliant purchases. With billions of pounds on the line, there’s a lot to lose.

To help companies understand the impact of inflation and gain a clear picture of the most common expense categories, we’ve analysed Concur Expense data collected in 2019 and 2023.

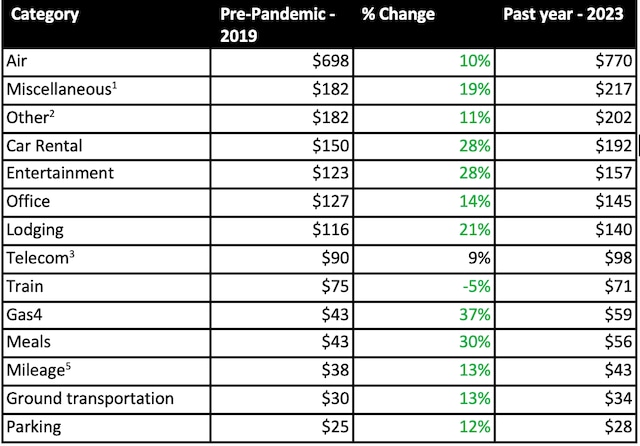

Average Cost per Transaction

Airfare was the most expensive purchase per transaction in 2023. The average expense for airfare was $1201, up 39% from $867 in 2019. That’s more than four times the cost of any other expense report category. Yet, while airfare was certainly impacted by inflation, it isn’t the only category with big changes from 2019.

Other expense items such as entertainment and car hire saw average increases of 36% and 33%, respectively. Inflation, supply chain disruptions, and the increasing cost of imports have also resulted in higher prices for food and meals, with an increase of 32%.

Interestingly, the average expense for train travel saw the smallest increase of 4% from $78 in 2019 to $81. Trains are a more sustainable way to travel, so a less-than-inflationary increase cost is good news for companies looking to swap car or plane travel for rail.

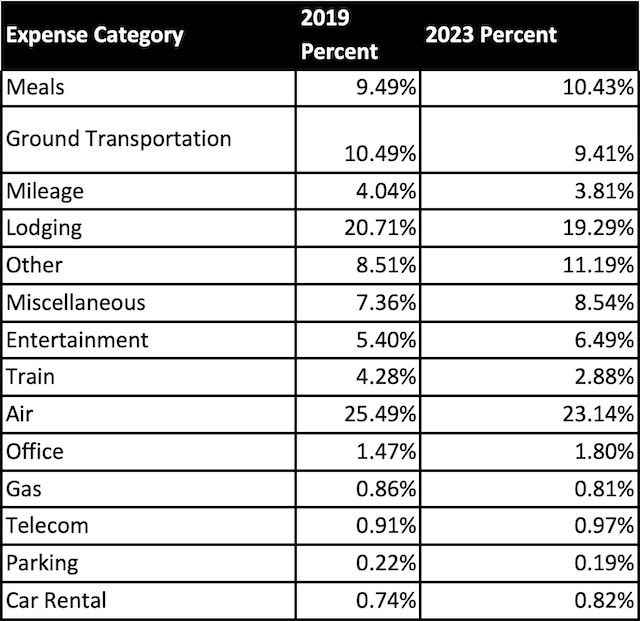

Spend by Expense Category as a Percentage of Total Spend

While airfare is the costliest per transaction, it’s also where we see the most spending with 23% of costs. In 2023, % 19% of expense spending across transactions in Concur Expense appeared in the “lodging” category, making it the second most expensed category in terms of total spend. The cost of expenses in the “other” category took third spot with 11% of the cost.” category also increased from 9% in 2019 to 11% in 2023.

These murky areas of “other” and “miscellaneous” represent expenses that don’t fit within existing categories or refer to expense categories outside of the norm. For example, we saw an increase in “miscellaneous” and “other” expense categories during the pandemic when employees were expensing new home office equipment or PPE. In terms of the volume of expense transactions, those in the “other” and “miscellaneous” categories are increasing, making up nearly 20% of expense transactions. These are commonly-used expense types, but it’s important that companies have insight into what employees are spending on to ensure compliance with expense policies.

“Inflation is certainly the main culprit when it comes to higher prices,” said Chris Juneau, head of market strategy at SAP Concur, “but the nuances in the data showing rising costs and shifts in spending habits provides valuable insights that should be used to guide business decisions, spending strategies, and travel and expense policies.”

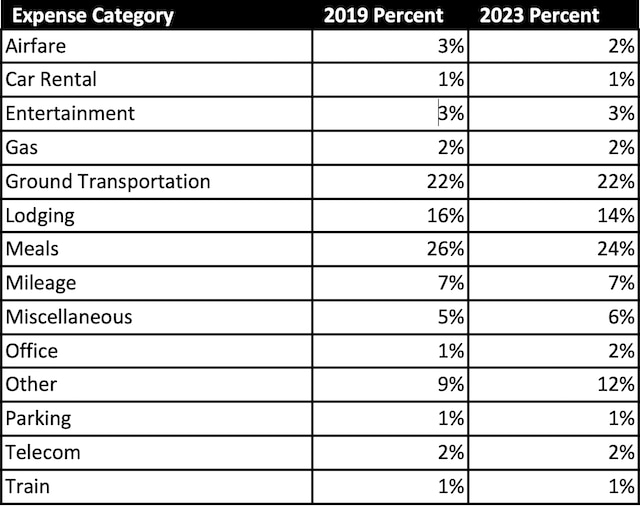

Volume of Expense Transactions as a Percentage of all Transactions1

Our third look inside the data shows not how much is being spent, but how often employees are spending in each category. In a given year, the three most common expense categories based on volume of transactions, in order, are meals, ground transportation, and mileage. Over one in four expense transactions involve employee meals.

Business expense categories help companies track and manage outgoing spend. A robust list of expense types allows companies to increase oversight into employee spend and help establish guard rails on what can and can’t be expensed through expense policies.

Tips for Expense Policies

Managing employee spending across expense categories and payment methods can leave room for error and non-compliance. But with clear expense policies, organisations can reduce ambiguity and non-compliance, saving time and money while reducing risk. Consider these seven tips for developing or revising expense policies:

- Review existing policies and elicit input from finance leaders and employees on what has been effective, what hasn’t, and what must be updated.

- Tap technology to look at spend data. Reexamine your “other” or “miscellaneous” categories and find out what employees are spending on. This could result in adding new expense types or adjusting category names if they’re confusing. Learn more about common expense categories here.

- Work with solution providers or industry experts to understand current economic, social, and behavioural conditions that might impact employee spending—for example, differences in how employees made purchases before and after return-to-office initiatives.

- After gathering information, adjust policies to be fair and sensible. Write your policy to guide behaviour but be flexible enough to adapt to local and international travel requirements. Be explicit about what is and isn’t an acceptable expense.

- Remove the jargon from policies. Make sure they are easy to read and not bogged down by unfamiliar terms. The easier a policy is to understand, chances are better your employees will follow policy on their next business trip or purchase.

- Make sure your policy is simple to find and use. Your expense policy won’t be followed unless people know about it; make it visible and include in internal communications.

- Take a future-forward approach to technology. Without question, you should be using a mobile-first solution that makes it easy for employees to submit expenses on-the-go from their mobile devices. Additionally, ask about current AI-powered capabilities and how your technology partners are planning for the addition of generative AI for such things as helping employees better navigate expense policies.

1 Miscellaneous refers to expenses that don’t fit within current expense categories

2 Other refers to non-standard expense categories

3 Telecom includes wired and wireless telephone fees as well as the costs of phone and communication devices

4 Gas refers to fuel expenses

5 Mileage refers to reimbursement based on miles driven

Methodology: SAP Concur analysed aggregate expense reports in Concur Expense between January 1, 2023, through December 31, 2023, and equivalent time periods from 2019. Expenses for this analysis were tagged as “airfare,” “car rental,” “entertainment,” “gas,” “ground transportation,” “lodging,” “meals,” “mileage,” “miscellaneous,” “office, “other,” “parking,” “telecom,” and “train.”