How High Performance Companies Stay on Top with Digital Spend Management

This past year has taught us that businesses must be prepared for anything – and no more so than for SMBs. Whether you are surviving or thriving, having tight control over budgets and cash flow is critical to managing change. Many companies are looking to ramp up digital capabilities in order to become more agile. And those that already have find themselves one step ahead.

When it comes to keeping an eye on spending, digital expense and supplier invoice management are key tools in any company’s financial management landscape. To find out how they are helping – and which companies are using them to their greatest advantage – SAP Concur sponsored two global Aberdeen research surveys of more than 600 businesses with more than 1,000 employees. The first report focuses on how digital spend management helps drive efficiency and performance. The second report looks at how companies are benefitting from strategic insights gained from spend data. In both reports, Aberdeen has classified respondents according to several key performance metrics and deemed those in the top 20% as “best in class.” It then compared how these top performers are leveraging digital expense and supplier invoice management technology to stay ahead of their peers.

Across the board, survey respondents report manual, paper-based processes as roadblocks to better cash management.

For expense management, they lead to inconvenience and frustration for employees, who must worry about saving receipts and digging through credit card records in order to fill out reports. Finance teams must then spend time correcting errors and chasing down approvals from managers. This all leads to long reimbursement times, high expense processing costs, and decreased productivity.

For supplier invoice management, the biggest issues reported were limited remote capabilities for capturing, processing, approving, and paying invoices. Manual errors lead to inaccuracies, duplicate payments, and delays. A lack of visibility into consigned or supplier-managed inventory is also a problem, which can lead to stockouts and missed sales or cash tied up in excess safety stock. Finally, accounts payable teams often find it difficult to effectively manage peaks and valley in invoice volume.

Whether your company has already begun to invest in digital spend management or you’re starting from scratch, there is a lot to be learned from how best-in-class performers are managing their company spend. The vast majority (74%) are using an expense management solution to automatically capture receipts and manage expense reporting workflows.

Mobile capabilities are also a key spend management feature for top performers. This means that, at the start of the pandemic, employees from these companies were more likely to have the mobile receipt capture, invoice submission, and report and invoice approvals they needed to continue doing their jobs from the safety of home.

But beyond the efficiency gains offered by digital spend management technology, best-in-class companies are 87% more likely to be using the analytics capabilities these tools offer to deepen their spend insight. In fact, top performers are 50% more likely to be using spend data for auditing and to help ensure budget compliance. They are also 31% more likely to be using that data to track and manage budgets and 15% more likely to be using it to manage cash flow.

But beyond the efficiency gains offered by digital spend management technology, best-in-class companies are 87% more likely to be using the analytics capabilities these tools offer to deepen their spend insight. In fact, top performers are 50% more likely to be using spend data for auditing and to help ensure budget compliance. They are also 31% more likely to be using that data to track and manage budgets and 15% more likely to be using it to manage cash flow.

Finally, no matter where you are in your journey, integration will be a key factor in the success of your digital spend management transformation. Top performers are 25% more likely to have integrated expense and supplier invoice management solutions with each other and to have integrated both with back-end ERP or finance systems – giving finance teams and business users the spend data they need, where and when they need it.

So, what does this all mean in terms of business outcomes?

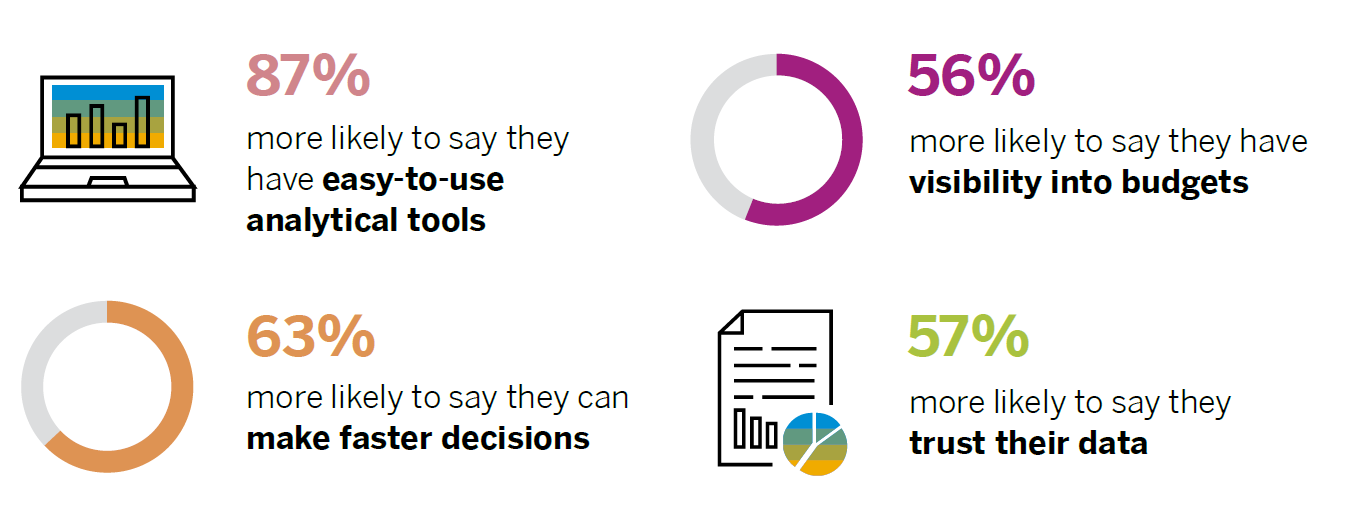

Best-in-class companies are able to get things done faster, more efficiently, and more cost-effectively than their peers. For example, they spend nearly five fewer days on average getting expense reports approved and save £8.90 on average per expense report. They are also 57% more likely to report having confidence it their spend data, 56% more likely to report having visibility into budgets, and 63% more likely to be able to make fast decisions.

Over the past two years, all of this has added up to a significant edge over the competition. When compared to other companies, best-in-class respondents report:

- 26% improvement in productivity

- 24% improvement in profitability

- 17% faster cash-to-cash cycle

No matter your outlook for 2021, digitally transforming how you manage company spend can give you the flexibility, efficiency, control, and insight you need to get ahead. To find out how, read the reports from Aberdeen. Or check out the highlights in this infographic.